The Of Vancouver Tax Accounting Company

Wiki Article

Some Known Incorrect Statements About Virtual Cfo In Vancouver

Table of ContentsPivot Advantage Accounting And Advisory Inc. In Vancouver - TruthsNot known Factual Statements About Pivot Advantage Accounting And Advisory Inc. In Vancouver Tax Consultant Vancouver Can Be Fun For EveryoneThe 25-Second Trick For Vancouver Accounting FirmTax Consultant Vancouver Fundamentals ExplainedWhat Does Pivot Advantage Accounting And Advisory Inc. In Vancouver Mean?

: While buying an existing practice may show up to be a simple approach to beginning an accounting company, the market normally has even more customers than sellers. This gives vendors the possibility to select a buyer with extensive experience to shield the passions of business's existing clients. Buying a method indicates acquiring a customer checklist and other properties, however it's also the most pricey alternative.are a preferred option for solo audit firms since they enable owners to pay themselves as employees, although they call for consolidation costs. are the most usual form of organization entity for companies because they restrict the obligation of proprietors as well as investors. Nevertheless, operating a C corp features lots of demands, such as the requirement to hold yearly conferences and documents monetary disclosure declarations.

Coming to be a signed up agent needs passing a test or having enough experience as an IRS worker; representatives need to additionally pass a background check. Place has much to do with the option of an accountancy company's specialty. For instance, accounting companies in country locations are more probable to focus on offering the bookkeeping demands of agriculture-related companies.

Cfo Company Vancouver - An Overview

Its is a short expression that connects the service's most vital facet or quality. Taking on a constant that is made use of in all online as well as printed product aids interact the company's brand - Vancouver tax accounting company.

Local business aren't likely to call for the services of a full-time accounting professional, yet larger companies have to choose whether they'll use inside bookkeeping or opt for an outside bookkeeping firm, as Inc. discusses. The key credentials that businesses look for in a bookkeeping firm use to companies of all sizes.

The 2-Minute Rule for Vancouver Accounting Firm

: Demonstrate to prospective customers that your bookkeeping firm can meeting all their demands, whether basic year-end tax records as well as economic documents, or more in-depth financial preparation and retired life suggestions. Accountants understand the value of approaching a job deliberately. Having a well-balanced plan and also being extensively planned for success are key actions when starting an audit firm.Nevertheless, most importantly, we use commitment to as opposed to mere involvement in your tax obligation administration and also bookkeeping procedure. By doing this, you can keep control over bookkeeping compliance job as well as have access to competent audit resource with regional proficiency, that are familiar with regional audit compliance demands as well as follow any type of adjustments in regional guideline - CFO company Vancouver.

Advisory services branch even more into: M&An advising Restructuring Due persistance Consulting Evaluation is the technique of identifying the true worth of a company or asset. Strong logical expertises, a capacity to analyze economic declarations, and also proficiency in financial markets are vital for those to prosper at an occupation in evaluation.

The 7-Minute Rule for Vancouver Accounting Firm

Stay clear of surprises and also save cash by intending ahead. Obtain sound advice without paying added for it. Be certain that every little thing is done on schedule and according to the federal government regulations. GST/ HST records from $39. 95 * IFTA reports for vehicle proprietors from $49. 95 * Payroll, T4, Compensations, Record of Employment from $49.

The Best Strategy To Use For Small Business Accounting Service In Vancouver

Cookie policy: This web site makes use of cookies. We use cookies to provide an optimal individual experience on our website.They'll aid examine your idea, determine Vancouver tax accounting company your start-up and operating expense, as well as create legitimate profits forecasts. They likewise understand which lending institutions are playing ball at any type of one-time, so you can approach the appropriate people for money. Plus they'll deal with your pitch, so you prepare to excite those lending institutions.

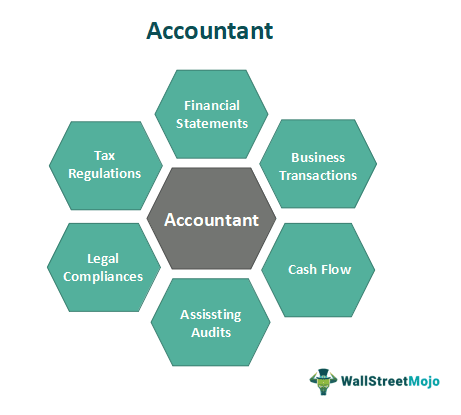

Payroll services take treatment of correct payment to the employees, sending withholdings, and also paying state and government pay-roll taxes. Tax Accounting: One of the most usual factor that any kind of business uses the services of an accounting firm is to file annual income tax return. Tax obligation Accounting professionals are experts when it appears to requirements as well as just how to prevent paying tax obligations unnecessarily.

7 Simple Techniques For Vancouver Tax Accounting Company

Prep Work of Financial Statements: Financial Statements include prep work of earnings statement, cash circulation statement, revenue and also loss account, as well as balance sheet. An accounting professional prepares this critical document as well as likewise assists in understanding these financial declarations for better choice production.CA Sundram Gupta is a Chartered Accounting professional as well as forensic auditor having 10 years of experience in the field of Auditing, GST, Revenue tax and Audit. He has actually given assessment to unique sectors over these years.

Report this wiki page